So where are we?

To understand where we are, we need to first step back to reiterate what our journey has been so far, and how far we’ve come.

We are pretty much a self-funded project, save for less than a handful of valued investors. No one from the management and foundational team draws salaries, and while we are a little beyond being ‘bootstrapped’, we act with mindfulness about our costs. Our major costs include onboarding onto exchanges, marketing, and development. Whatever can be achieved in-house, from foundational business modeling to the design of the UI and UIX, we have undertaken to maximize what we have. Given our in-house talent, that’s also a good use of our resources.

The majority of funds raised, including grants such as the one given by Polygon Network, has gone towards development.

In 2021 we released a very early, pared-down Alpha version of VersoView for Garuda Indonesia’s inflight magazine Colours, which we have kept updated monthly with every new edition of their magazine ever since. In the same year, we launched a closed Beta with Bank of Central Asia – the largest privately held bank in Asia – on their private, internal network, which houses a digital copy of their HNWI magazine, Prioritas – accessible only by those top tier customers. BCA’s beta uses some core features of the VersoView platform; subscriptions; chat; highlighting; bookmarking; inventory; and data capture.

These two early clients gave us, and continue to give us, insight into how VersoView might be used, which we took on as we developed the footprint that will become the VersoView ecosystem part 1, and form the structure of our closed beta public launch.

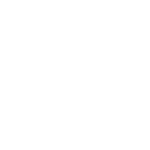

At the beginning of 2022 we really kicked off our development programme under the guidance of our CTO, Ro, and supported by our internal talent and external development teams. Huge progress has been undertaken, especially with the two primary areas of focus; the VersoView mobile app and what we call the ‘wizard’ – which is the ability to upload content into VersoView on the web.

It’s hard to accurately place a % figure on where we are at this stage, but the general feel from the team is around 90% with the app in both functionality and design on both iOS and Android, and about 80% with the wizard.

The app looks fantastic.

We’re proud of the intuitive way it functions, how you flick through content (think Instagram for articles), and the layers we’ve built in that answer the demands of publishers and users alike.

Our chat module builds on what feels familiar in Telegram, but how we’ve then integrated this chat with content takes it to the next level, while being entirely relevant to the type of content on our platform.

Our wallet functionality works cross-platform, and is ready to be integrated with our VersoRewards structure, as well as house NFTs and other tokens.

We also love that when we look at other class-leading apps out there, our layout is as good, if not better. Type. Spacing. Layout. Feel. At the end of 2021 when we largely had the design done, we compared class-leading apps and platforms, including The New York Times, The Guardian, Google, Flipboard, etc, etc – and our app stands tall. Given their collective hundreds of millions in research, design and UIX resources, that feels very good.

The core functionality of the wizard works, which is the ability to upload and AI convert content. There are modules still to be integrated, such as some design and administration elements of how a user, content creator, business or publisher would upload and assign their inventory.

There are some other key components that we’re keen to polish off too, specifically subscription integration, subscriber management and payment gateways – which are largely third-party integrations and are in place, but not executed yet. We are also still refining the rewards mechanism(s), but that will come when we’re able to finally release the closed public Beta. We have also laid down the foundations of some API integrations, such as DocuSign, MailChimp and SalesForce, which gives business some familiar tools to work with.

So where are we, part 2?

Funding

This brings us to funding. As mentioned, we’re very much bootstrapping the platform, and indeed we all have other roles which enable us to continue with VersoView and cover its day-to-day costs (and indeed our own costs), including our two-person in-house dev team who are critical to give consistency for our existing clients. The other roles played by individuals may have positive impacts on VersoView, potentially opening up routes such as, but not limited to, talent and funding.

We released our first Pitch Deck on December 2021 – which followed the sign off on what dev we were undertaking – and have subsequently updated our messaging throughout the year based on feedback given from those we’ve pitched to. Our current iteration has largely told the same story since Q2 of 2022, though we refine it depending on who we pitch to. Given our design background, it looks as good as the app does. We’ve had modest success (in our eyes) and continue to follow up on leads, while generating new ones.

VersoView is quite a complex beast. It’s an AI publishing toolset; Social media platform; Web3 NFT blockchain wallet; decentralized moderation; and Direct-messaging app – all wrapped around building communities around content.

We’ve found many investors want you to be one thing only – a ‘robot bricklayer’ – else they can’t put you into a category. In that context we’ve had – sometimes bewilderingly – a pushback on us being such a forward-thinking, complete platform. However the world is catching up, in parts, to us.

For example, Twitter has been announcing the benefits of long-form copy (which is what VersoView is built around), and they are extending their word count. Twitter is also flirting with having an integrated wallet function (er, of course!), and are almost directly mimicking how we bookmark (ours is better as it provides an integral function). While Twitter encroaches on our offering, it’s actually been of great assistance to us as VCs and others can use those as reference points, and it gives us validity.

In general we’re finding the bulk of investors want you to be launched, making some money and broadly proven before they open their cheque book, so we’re targeting a far smaller pool. Our business modeling is fundamentally solid and proves the platform works, even at a fraction of a size of what it has the potential to become. Our needs, even to a full launch with massive marketing spend, is low millions. Our short-term needs to get to closed public beta are far less. We specifically mention this as we’re not in need of $10s or $100s of millions to attain our goals, so our pool is broader in terms of talking with VC funds and individuals.

We continue to pursue funding options in Australia, Singapore, the US and Indonesia – all territories the team have experience with. Singapore and Indonesia are consistently offering the best opportunities, with Julian and Iggy racking up the air miles. We have a couple of potential massive education projects that we are perfect for, but need both the additional funds to get to closed public beta, and then funds thereafter to obtain accreditation in those sectors, and we enjoy open discussions with them.

We are excited by the opportunities and individuals we are pitching to for investment, though we have healthily low expectations of conversion (you have to).

So why don’t we just launch?

We’d love to but there’s some critical development we have to resolve, along with ensuring we retain a budget to keep us online and responsive for a number of months while the closed public beta runs. What we have works, but it’s not the platform. We’re very aware that, as Mark Cuban says “perfection is the enemy of success”, but you also only get one chance to make a first impression.

We’ve actively paired down conversations with potential platform clients, as we must hold off until we have a clear runway. We have dozens of clients, corporations, education establishments, content creators and more – some of which we’ve published MOUs with already – who have seen VersoView and want in (as they understand where we are in the process so are very understanding), but we simply can’t deliver the experience that will keep their users and subscribers there (who won’t be as understanding and just delete the app).

We’re not quite chicken and egg, but we must secure more funding to launch, and ensure there are funds beyond launch to get us to the next stage. We’ll continue to bootstrap, and continue to pitch to new VCs as well as follow leads we’ve already generated. That might take 12 weeks, or 12 months. Colonel Sanders peddled his deep-fried chicken 1009 times before someone said yes. Sometimes you just gotta keep knocking on doors.

We’ll endeavor to update more frequently, and we’ll seek to place VersoView in a broader context via TG and Twitter, which will help promote our message.

For sign off, I’d highly recommend reading (or listening to) The Psychology of Money by Morgan Housel. He laments the need for time, patience, and a healthy slice of luck in investing, and how we think about money, and why.

Steve Peaple, CPO.