The VersoView Foundation is pleased to announced that following our comprehensive business modelling and emissions analysis, as reported to the community in our updated emissions schedule last week, we no longer need the total token supply that was projected at the start of the project, and as such, that surplus supply will be permanently reduced.

Today we will permanently reduce the total supply of VersoView Token to 200,000,000 VVT.

The 1,800,000,000 excess $VVT tokens will be sent to the Ethereum 0x000 lock address and represent a total value of $400,000,000 worth of VersoView Tokens being locked forever.

Why are we doing this?

When we launched in December of last year we did so with very little funding, and no private or public sale rounds. With an effective market cap of just $200,000 our emissions projections for funding needs suggested that our original supply of 2,000,000,000 might be necessary over the lifespan of the company.

However, due to the overwhelming success of the project in the first few months, combined with our commitment to self-fund large portions of the development cycle and a tremendously successful Series A round, our need for token emissions has been drastically reduced.

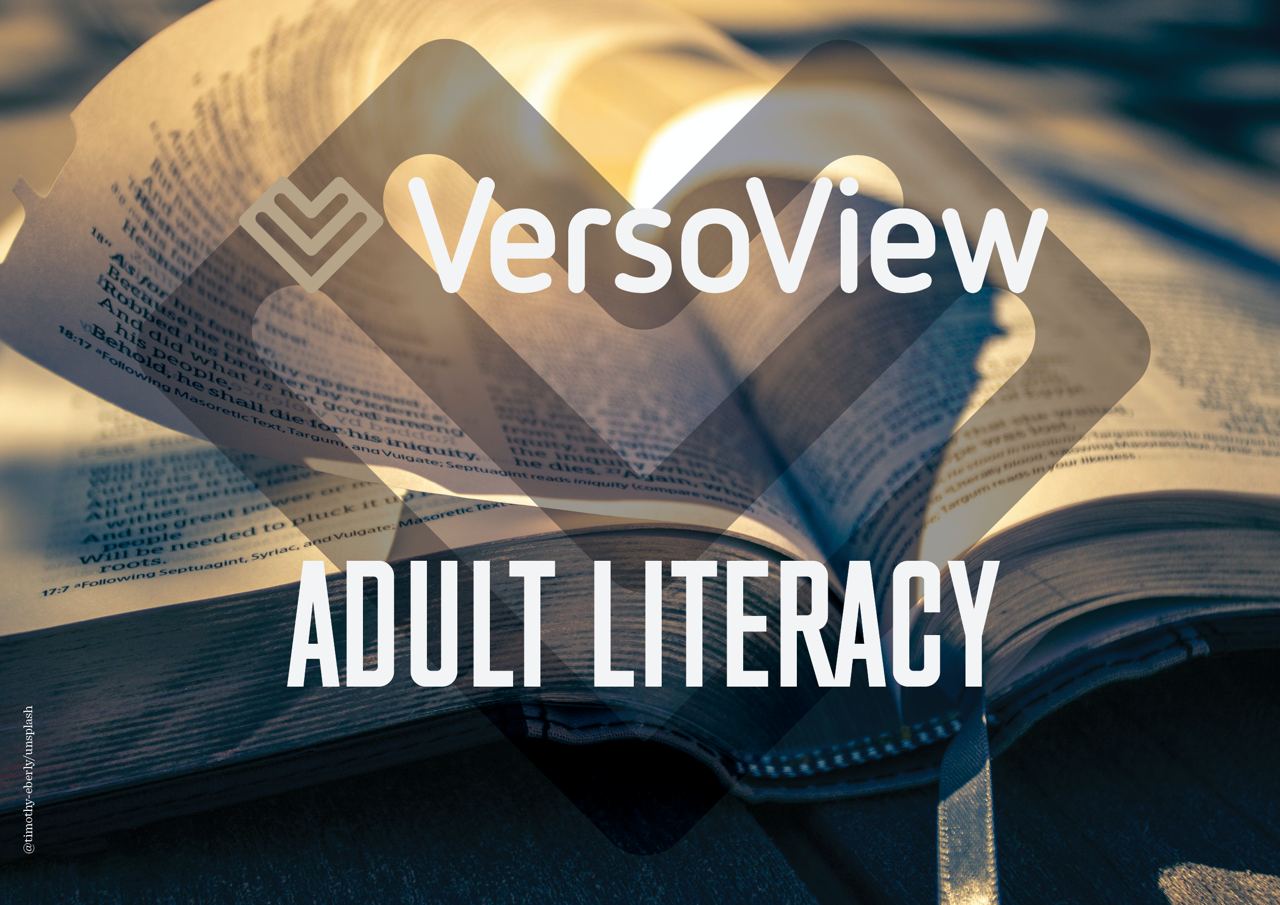

As reported in our emission schedule release last week, the highest projected total of circulating supply would have been no greater than 250,000,000 VVT in the year 2025.

In addition to this, we have held detailed discussions with our development team who have raised concerns about the latency and coding challenges presented by the number of smart contracts that would be required by our Ecosystem Rewards Pool tokenomics mechanic. In talks with our Advisory Board, these respected business leaders have given detailed insights as well that the mechanic may add unnecessary complexity without significant added value, and lastly, our community has been vocal about the size of uncirculating tokens, and the impact that it presents with potential investors and that even though a business use case exists for those tokens, the concern still exists.

For all of these reasons we have adjusted our tokenomics to eliminate the Ecosystem Rewards Pool and adjust the revenue mechanics accordingly. This is projected to have no measurable impact on our business and will accelerate the deflationary nature of our tokenomics and increase the velocity of tokens returning to the Staking Rewards Pool.

Moving forward

Beginning today, a series of token movements will begin, with tokens moving from each of the team held wallets to 0x0000000000000000000000000000000000000000 where the tokens will be locked away permanently. We will work with CoinMarketCap and CoinGecko to update their reporting of the total supply metrics once the token migrations are complete.

You can see the final token distribution totals below and the minor updates to the emissions schedule caused by the elimination of the Ecosystem Reward Pool.

Below is a list of the VersoView non-circulating supply wallets, their current function, and totals before and after the supply reduction.

Marketing & Exchanges

0x073369B0991C23503dFB8074B5ad6a68FE9FEA79

Current VVT: 200,000,000 / Post Reduction: 40,000,000

Development Pool

0x3949E304653c08c37BAc90d1843e8a6832B125E2

Current VVT: 300,000,000 / Post Reduction: 50,000,000

Business Development

0x021419545b9b0E69d5D9E4fAeBB57860a538eb9f

Current VVT: 300,000,000 / Post Reduction: 0

Future Liquidity

0x2CCEA57428631C6705b3392504F0f942Bbd504d4

Current VVT: 260,000,000 /Post Reduction: 0

Team Allocation

0x2c111c5587aaBE15f51BDcad0190270EEbbd0056

Current VVT: 400,000,000 / Post Reduction: 30,000,000

VersoRewards Staking Pool

0x3FAC8F48aE5f0AEDecd1e0a81A602756777F50e8

Current VVT: 200,000,000 / Post Reduction: 40,000,000

VersoRewards Ecosystem Pool

0xB061e640FE04F4acD206ef61D9A01345938b7029

Current VVT: 300,000,000 / Post Reduction: 0