Steve Peaple and Alex Moody (VersoView) had a great video interview with Blockchain Brad lately. We made a transcript out of this. Enjoy reading!

b: Brad Laurie

s: Steve Peaple

a: Alex Moody

b — Hello it’s Brad Laurie of Blockchain Brad and today we’re speaking about all things VersoView, and to do that we have two members of the team here to explain exactly what they’re doing

Firstly we have the CPO, his name is Steve Peaple.

Steve, thank you very much for being here.

s — oh it’s great Brad it’s lovely to catch up with you and to be able to unfold more about our story with you today

b — absolutely mate and obviously not many people know about VersoView, but one other person in the team who does his name is Alex Moody.

Alex we’ve been chatting a little bit and texting to try and prep this interview thank you for making time today. You are the Director of Operations and certainly know a lot about this team and this tech

a — Absolutely Brad. It’s a real pleasure to be here. I’ve been following your work for quite a few years here in the blockchain space. Its transparency and the incredible interviews that you do with CEOs and C-level executives for the blockchain projects is awesome and I’m just thrilled to have an opportunity to do it and showcase what we’re putting together with VersoView.

b — Absolutely mate, and on that note it’s important that all the public know that I am not invested in this token. I certainly am here for the transparency and the trust and here for the community to make sure that we are aware of these innovations as they do come on the blockchain and beyond.

Now, gentlemen, business is the buzzword right now for a lot of things happening in the Cefi, Defi, Open-Fi space you are doing something that’s backed by experience arguably from your team and from your advisory board as well but let’s start with the three words that matter…

PUBLISH, ENGAGE, REWARD

Let’s start with; publish, engage and reward.

Steve, you want to start and just let us know you have a lot of experience especially in the public publishing side of this what does it mean when we talk about VersoView

s — So publish, engage, reward is really the life cycle of what VersoView is offering. Myself and Julian — the CEO — have worked together for a number of decades, originally in the UK where we were one of London’s first digital media agencies back in the day — when it was called multimedia — and then we moved into the publishing space about 25 years ago, initially with in-flight entertainment guides and then magazines.

We’ve always approached projects with the respect of what does the audience require, what do clients require, in order to facilitate their transactions? And what the audience are looking for in terms of transparency, or ease of use, and that’s always worked really well for us. VersoView has really come about from that kind of 25 years or collective 50 years, I guess of mine and Julian’s experience where we’ve consistently had a digital edge to our companies, and we’ve consistently had feedback from our clients; both corporates and client-facing (so airlines, luxury brands, etc), and their response has always been that they need a kind of digital platform to support themselves with.

We went out into the marketplace to see what was available, and we’ve used several of those tools that are available, and largely they sit in one of two camps; the first being the kind of free or very cheap kind of page-turner so you get your phone and you have to kind of scroll and flick and pinch and zoom in and out, and it’s quite a cumbersome not very user-friendly interface; and then the step up from that– especially if you want a mobile App, Android iOS App — starts to cost serious resources, either financial or staff resources — or often both — up to the level of you know the low millions of dollars a year.

If you’re going to go to something like Apple News+, it’s a really kind of media-rich format, and our clients simply won’t invest that sort of level.

So you have very large kind of corporate clients of the likes of oil or airlines, in you know hotels, etc. Within those kinds of or within all industries, they typically will have you know one or two people in marketing and so digital becomes just part of the things that they need to do. So they’re never going to invest hundreds of thousands, or tens of thousands into a digital publication.

b — Okay, just interrupt you there. So obviously the poor quality sometimes of the interfaces and also the barriers to entry with cost are an issue right across the board and is some of the reasons for this development with VersoView but I also wanted to ask you more specifically as well Steve or Alex if you want to take the lead on this, why in a nutshell do VersoView other obviously those reasons are important, but clearly you’re moving into this tokenized realm now with crypto being component of this uh clearly you know you’ve been looking at this for a while.

BLOCKCHAIN ADOPTION

a — Yes, let me jump in there. One of the things that drew me to this team. I joined the team earlier this year after knowing Julian for quite a few years from mutual interactions within the blockchain and crypto space, but what immediately attracted me about this was the team.

You know Julian and Steve’s experience with their incredible Rolodex of existing clients — because one of the things that have been a frustration and it’s been sort of a roadblock in blockchain adoption is great ideas are built all the time incredible technology is created every day in this space, but frequently there’s nobody to use it exactly.

The C-level executives and the developers, the coders just don’t have the relationships or the business development skills to actually get their products usable, or used; they’re usable but not used, and so what these guys brought to the table was this huge Rolodex existing clients that had a need and then the rest of the team myself and our other team members are are many of us most of us are all previous executives in various industries.

I’ll give you an example; I just laughed this past Tuesday. Two days ago, or yesterday, I had a call with a former executive a current executive from my former industry about VersoView — kind of give them an overview — this is a friend of mine with a business that is one of the top uh in the vapor products industry distribution manufacturing in the united states.

So we communicated — I gave them the sort of had a good conversation about what we do the challenges that they face — and the feedback that I got yesterday is exactly the same as the feedback we’re getting from every C-level executive we talk to — and we’re having these conversations constantly with these executives about what VersoView does, about the challenges in the industry.

Always that the trend has been — but especially in a post-Covid world — that humankind is moving to a more digital platform. Everybody is getting we see Facebook, Instagram, Medium, Telegram; we are all moving online we’re all moving to these digital communication spheres digital content and the problem is so we would think that engagement is going u,p and the problem that we’re finding — or the problem that these executives are finding — is that their engagement their ability to engage and maintain the engagement of their client base is declining. And with it is going is revenue.

And so you have we ask ourselves why? Why is that happening? How is it possible that in an accelerating digital world where people are stuck at home they’re stuck on their phones and their computers we’re seeing less engagement with the brands that matter and it’s because of the quality of content and the quantity of content?

REWARDS

b —So how do you fix that problem? And how do you incentivize it also?

a — It’s rewards.

So it’s finding the balance. VersoView does it in three ways; the first one is quality of content — it’s how you how do you curate quality content. And Steve can talk better about that –And the second thing is how do you pair that quality content with the right audience?

And the third part is how do you effectively engage and reward the engagement of those users? So that’s where publish reward publish engage reward comes from because it’s the VersoView model for how we take any company, product, brand, organization, education, a professor of a university; they all have a story to tell. A Rolex watch tells a story, but if your customers are constantly being bombarded by a million low information stories all the time every day, the story that this used to tell with a picture is devalued.

b — Right, so how do we well let me stop you.

a — So get back to that story centred content and then reward the users for engaging the content that matters to them.

a — Exactly. I mean there’s a bit of an elevator pitch in that whole spiel right there but essentially in the question of why VersoView what I’m hearing from you here Alex is that there’s been a lack of proper incentivization structures in the past designs, especially in the mainstream when we’re now moving into a very decentralized, or very robust social media world where it’s 24/7.

So that reward aspect we’re going to unpack more, and certainly, look at the what VersoView.

BUILDING THE TEAM & TECH

But let’s start a little bit more on the team. Alex, you started on that you took the question and ran it. But that was my next one with regard to the background the expertise that is important from the team from the founders and even to the advisors. So I’ll start again with you Steve, you want to just give us a bit of a rundown very openly and broadly on the necessity of expertise and what you do have to offer as a team.

s — Yeah, it’s multi-layered. So myself and Julian have run businesses for you know nearly 30 years together and our ethos has always been to put the best people around us as possible — as none of us is naive enough to assume that we are the best at what we do — there are certain key elements of my own experience and skillsets that may be very good in certain areas but equally, I’m very poor in other areas so as a team we look at all the weaknesses first and foremost and find people who plug into those weaknesses who are just superb of what they do.

So there’s a thing called the Peter principle where you’re very good at one job to get promoted and promoted and then suddenly you’re in a job that you’re no good at because you was promoted into that role rather than ready for that role, and we use that very clearly into how we build a team as well. Whether that’s for publication, whether that’s for a client, and obviously now that’s for VersoView that’s our kind of holistic approach.

We’ve been working kind of remotely with people for 20 years or so so well before kind of elance and freelance.com kind of started. We’re very used to working in that sphere and in that way and so really it’s about building a set of key skills that are required for that specific project, and this specific project is the all-encompassing VersoView that we are.

b — Okay, well let’s unpack this a bit more thought because specifically, we see things like the AI experience; we see a strong publishing experience; a lot of marketing experience as well mainstream, especially what about tech experience as well built into this.

Steve, I was finding that that was a difficult thing to find obviously you have a proprietary check we’ll talk about later so where does that fit in with the team who specifically manages that?

s — Well we’ve actually — and this is a little nugget for you — we’ve actually just signed a new advisor. A guy called Ro who joins us as a Technical Advisor. His background is 11 years as VP of Credit Suisse, he was VP of Strategy and Digital Transformation Leads, VP of Global Head of Architecture, and VP of Global Head of Algorithmic Training Technology — and now he’s leading up our technical team as well.

So that’s been a massive hire for us. His experience, in terms of layers of security especially at places like Credit Suisse — they’re not unparalleled… it’s a superb hire for us.

b — Okay so what about with regard to the proprietary tech though because you’ve had that for some time even though you have now enlisted new parties or advisors into your team. So what about that you know how robust is that team?

a — Well Agency Fish is Stephen and Julian’s previous –actually their main company — their main business has a subsidiary, Network Fish, that they use to do most of their current programming. [They] manage all of the digital publications that they currently released.

…They’ve been self-funding the VersoView project since early 2019 and that a lot of the coding has been done through that and we’ve done some contract coding. We have two gentlemen that have been doing primary contract coding for us through that and ultimately built our MVP, so we brought on Ro to scale the AI back-end to get us ready to take us from Alpha to Retail release over the course of this year. That’s also supposed to be building out the blockchain front-end the AI back-end, hiring the UX team to finish up the final components.

b — Okay thank you for that transparency because I noted down Agency Fish and I assumed that that because you’re transitioning into this new sort of utility, that is the interesting crypto phenomena that have happened I assumed because of all the businesses core that you seem to have that you are utilizing some of those devs from the mainstream arena it would make sense to do so, especially since you’re not there for the puristic Defi agenda. You’re here as a profitable business.

So gentlemen, let’s discuss a little bit more about the advisors — for example, a colleague who might have known the space, Tommo, he’s part of this. Obviously, marketing is important for this advisory board, so what’s the plan there? What’s the main focus with the advisors and what do they do?

a — So, depending on who you’re referring to, like Tommo and myself, and the core leadership team?

b — Yes. I mean we talked about the tech advisor inclusion but what about…?

a — Right so you know Robbert. Robbert is a PhD candidate and teaches at a university in the Netherlands — his focus is on digital marketing and he helps us with content writing, digital concepts, marketing concepts, planning, strategic planning. Tommo manages our community, does a lot of our communications outreach. Networking within the blockchain space and sort of managing that the community aspect which is critical to everything that we’re doing right now.

b — It’s a tough job that one too he does very well.

ORGANIC GROWTH

a — It is. Right now we have this — we’ve our go-to-market strategy was a little bit different which has made in my opinion all the difference because of Steven and Julian’s sort of foundation background and willingness to self-fund for so long. We just basically refused all venture capital funds okay.

So when we launched, we decided to just list the token. We did it with no fanfare. We had nobody in our telegram channel. We didn’t get a bunch of bots to flood you know the interwebs with words of VersoView; we just did it and then we just started building and building a community, and slowly dripping out information about what we’re doing, and who we are.

b — So that’s really a real launch. Let’s forget that you know that word ‘fair launch’ is becoming quite annoying but the real launch is really just you know not constructing narratives and hype and promo and FOMO around this. It’s just the point at which you’re ready to launch that you did.

a — Exactly. So we just said, “Hey, the timing is right for the business, where it is, our roadmap makes sense from where we are”, and it’s now time to involve the market in the process. …What what we did was we just sort of decided to take a period of a few months, and what we call stealth mode if you will, where we’ve just done really no marketing. We’re not spending a lot of money on marketing we’re not hiring a bunch of people to say things about us, and we’ve just been discovered by people.

You know we had one or two people trickle in — I think our telegram channel has is 525 real people right now having substantive, meaningful conversations about what we’re doing and thirsty for more.

So as we deliver more content, whether that’s the great pieces that tell our story that are coming from Robbert and his team; or whether that’s more information about the token; or more information about the tech that’s coming out; that is just building the story, leading up to our Alpha release — is really going to be the moment that marks that the greater blockchain world kind of realizes how big VersoView really is.

b — Yes, and we’re definitely going to be talking about that after release. We’re going to talk about the roadmap — that’s very important — but essentially the message I’m getting here is that the tech and the team and the plan is paramount to anything else, which is often in reverse in this very convenient insta-minting, insta-token environment where you see a lot of things happening in the shitcoin world.

But in this instance really, you’re talking about those picking this up for those who want to position themselves regardless of where they’re asked if they situated in crypto or even speculative representatives. If they support long-term — this is your agenda — you want to actually build a real business out of this.

FILLING THE VOID

b — So gentlemen, let’s get into the guts of the tech for a second.

Now, obviously, neither of you are, you know, the deep techies of the team, and I respect that but do you want to just touch on the proprietary nature of this so that the layperson can understand; a) why your proprietary, b) what that means for your business; and c) are you Cefi as opposed to the Defi narrative that’s out there?

a — Why don’t you grab the beginning of that and I’ll handle the end. The Cefi / Defi?

s — Yeah absolutely. So really what’s different about VersoView is that kind of you know ‘see a need, fill a need’.

So we have identified through extensive research and personal use of the software that are available on the marketplace, and there is literally a huge hole in the middle between you know that kind of free page-turner, and the very expensive, resource-heavy end of the spectrum and our clients need something in the middle, which is [also] a Saas model. Relatively low cost, and it predominantly does the work for you.

So we have a patent-pending AI kind of module that will be put together — that’s it let’s say with legal and with the patent authority in the US — and that really does pave the way for us creating this kind of new visual kind of look.

When you get to see the Alpha release there’s no rockets involved. Like you’ll look at it and go, “well that’s that’s the way it should be, that’s kind of obvious” — and it is! What we found like the solution is pretty much obvious, but no one’s done it.

I think it’s because publishers have come from a publishing background, the tech — they’ve come from a tech background — and not so many people have had that real niche that our team has of 25 years of publishing and then you know a decade or more collectively in blockchain and crypto in terms… It is super, super niche, so we’re fulfilling something that’s niche anyway, and we’re doing it in a super niche way with the engagement and rewards as well.

b — Got it well Steve. I wanna just jump in there that’s okay mate? Can you tell me a bit more thought about this? The current state of the tech in terms of, say, for example, a techie wants to explore this more wants to explore Github. What can they do, is it completely closed source?

a — It’s closed source. So the tech is closed source, it’s not going to be Open-sourced. I mean at the end of the day we’re a corporation, this is a business that’s in the marketplace designed to generate revenue, and that the idea of — I love the idea of Open source — like you know Open source the world and all that but then your tech is just stolen and copied.

b — Yeah, we’ve seen that time and time again in Defi right now, and it’s ironic that we see a lot of the infighting happening for those who are proponents of Defi, but then they literally stand up on Twitter and start complaining that you know they’ve been copied.

So this makes sense, but let’s talk about the context of Cefii Alex, because you wanted to touch on that. There is a huge push right now for all kinds of startups on that continuum.

a — Right. I don’t think I guess maybe I’m unique in this, but I don’t think that open source and Defi — I don’t think that’s where the decentralization needs to happen in finance.

I think that closed source code and sort of unique proprietary financial instruments can create a decentralized finance financial world. I think it’s removing that it’s creating a trustless environment for those financial transactions. It’s taking out the Robin Hood getting to turn off Gamestop. Removing that overpowering or overbearing authority over the sort of the market, or the marketplace, is what is the foundational core of what bitcoin’s about– it’s the core of what decentralization of finance is about.

REWARDS

a — For us there’s sort of two components — we as a company, we’re not a Defi financial solution, we sort of straddle Cefi and Defi in a sense…. When we onboard a client, they’re a paying customer into you know a sort of a centralized business. Where Defi comes in for us is we actually create a decentralized financial ecosystem around the stories that the brands want to tell. So a client comes to us and the rewards and engagement program.

So rewards programs are they’re great but at the end of the day they’re really really not well executed to date. In America we have something called FiveSstar, I think these guys told me about something big in Europe that you know you buy points and then you can spend the points for them.

In most of the businesses that I know of, you buy nine coffees you get a 10 free. It’s so basic. But what happens when you get eight coffees but the coffee shop manager says “oh we changed that program, now we’re doing buy four sandwiches get the fifth free”.

We’re decentralized. We’re creating a Defi solution for that so when a business, or a brand, when the coffee shop wants to mint a social token — $coffee — and you’re earning coffee either by your engagement at their stores your participation or your engagement in their community aspect through the publications, you can spend $coffee and it’s decentralized. They lose the control, that ability to manipulate and control the earned rewards.

b — Right, so what you’re saying is that you are a Cefi by design in the sense of mainstream business, but that core integral token, that’s really what you’re alluding to that is the fuel that enables the decentralized aspect. Also to break those barriers down for the social tokens that we’re going to talk about because clearly, that is the, I guess, the rocket fuel to open up a whole dynamic in a whole platform to enable people to engage in a way they haven’t before and 24/7.

So I hear what you’re saying. Perhaps we need to really expand and think about the terminology that we currently have. Maybe it just doesn’t cut it to break things down into Defi / Cefi context.

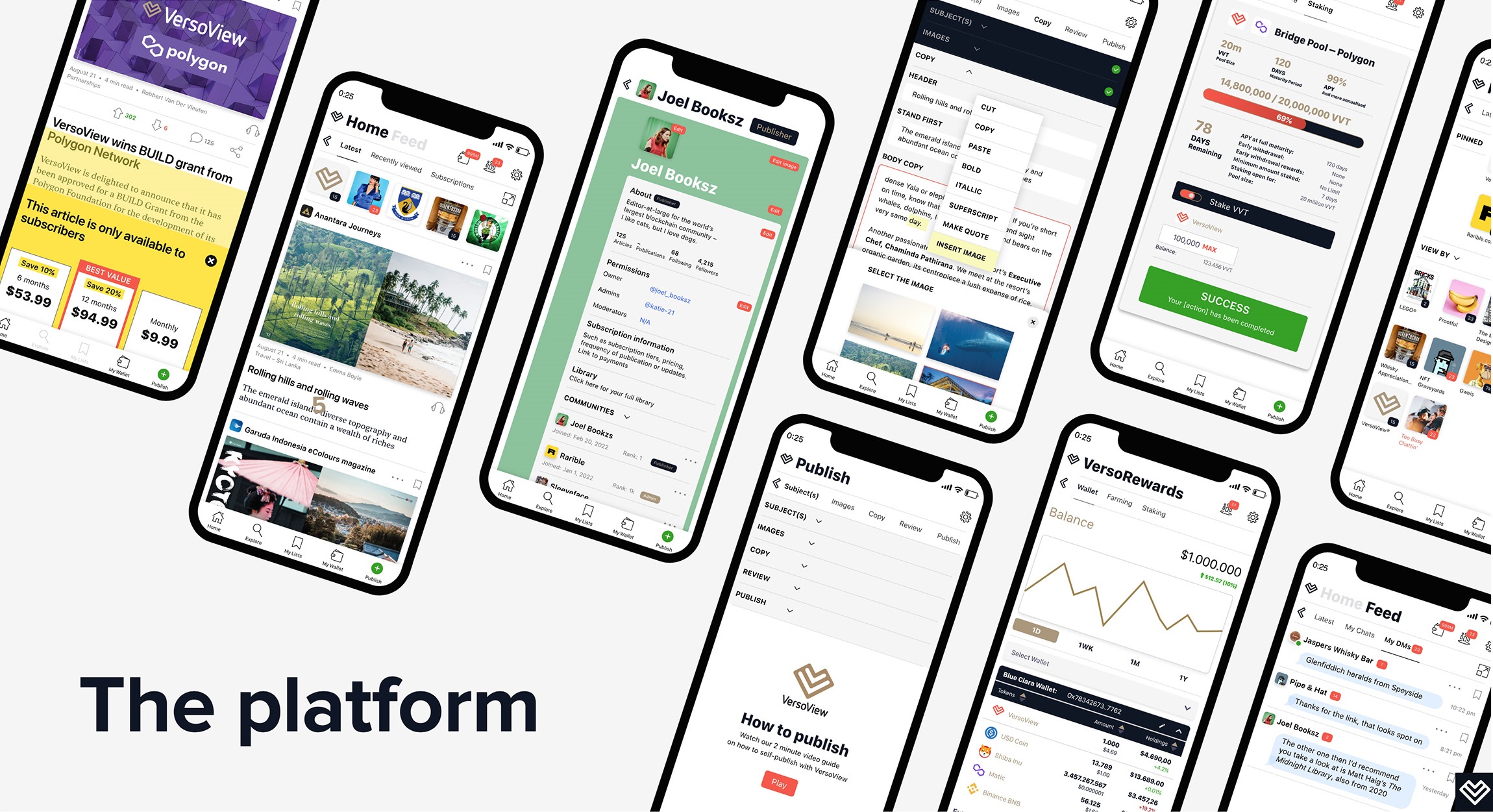

OPENVIEW

b — So gentlemen what about features? It’s clearly outlined in your information on your light paper and on your website but what are the core features do you think that matter most for those who are trying to really understand, grapple with the gravity of the thing you’re trying to build?

a — VersoView — when I think of like the you asked about the patent, what’s the tech do? We think of it that as a tool that’s the tool with which we onboard the enterprise. The enterprise comes to us because of the tool we can offer — and we’re the only ones who can offer it due to our patent-pending proprietary technology. The tool itself is like Steve said — it’s so intuitive. When they showed me how the MVP works I went, “Right, but that’s like that’s what it is right? I mean, that this isn’t new everybody must have this?” But everybody doesn’t have it.

So what it does in its simplest form is it takes print medium; the AI automatically converts it, properly formats it and delivers it into a perfectly formatted medium style what we call OpenView. What Steve was referring to… let’s say I email you a PDF right now you take that PDF and you pull up your phone and you go oh okay… so now I’ve got to try to find that one spot… oh wait now I zoomed into the one line but I’ve got to slide over to the other line…

What the difference is if you sent that through VersoView you would get the PDF and you’d be able to do the same thing where you flick the pages and look at the whole magazine, but you could also click on OpenView and it would pull it up into a Medium-style format.

And, then one step further, is you’re reading that that message — perhaps we’re business associates and you’re reading that PDF and you go well that I disagree with that statement entirely — you click on it, highlight it, and hit enter, and you go right into our social media function and begin engaging in the community.

And at that point, additional features will be added down the road map include built around the social tokens.

Think of it in these terms imagine if you’re a professor. I believe you have an education background am I right?

b — Yes

a — So imagine if you have VersoView, and you’re doing this sort of remote learning or whatever the case may be in your in your area — my kids are sitting doing school on a computer now — but what if you could send the sort of homework through a medium where the where the kids could do it on their phone or their laptop or their computer perfectly formatted. They could immediately engage in their classroom, and then be rewarded in a gamification-style method for their engagement with the content.

Imagine that.

b — Well we don’t have to imagine because that’s your plan. Now obviously those people who have experienced Covid, we’ve seen a lot of members of people in the world really having to grapple with that and they are isolated in many senses but really this is again another way that people can explore how technology can meld with rewards and that’s going to be something of a character because we already see publishing houses exist we see a lot of opportunities exist, as you mentioned with closed systems of rewards. But they usually are inter or intra-company, they don’t really explore beyond that and the potential and they do more often change. So this is something that can be quite generic potentially, and really move across companies much like we hear the crypto speaker bridging.

ROADMAP TO REVENUE

b — So Steve I want to ask you about revenue, because often when I talk to companies the revenue doesn’t correlate with tokens — and quite rightly so — because obviously building clients you making sure this is viable the token is a very specific use case there so where are you at with the process of making the transition from previous experience in Agency Fish across to this now and how’s everything going?

s — A tough one to ask I don’t really have the biggest financial background but now we have Col Werner who’s as CFO who runs all the numbers.

b — That’s okay I might just touch base with Col in another interview later. I guess I just wanted to hear are you making money, is there revenue happening now?

s — That’s not yet on our current time frame. It is on the road map in terms of when revenue kicks in and there’s obviously some extra depth to do in terms of scalability to allow that.

We are actually proactively not pushing VersoView to our clients because the uptake and the response has been so great that we know that the current dev literally wouldn’t handle that volume, so it’s imperative that our our dev is kind of repurposed for that scalability and especially for the security aspects of that, and that’s well within our roadmap, and that’s all you know very much in progress.

b –Yeah, and I noticed that the platform’s not coming through until sort of the end of 2021 as the full and robust platform that you’re now building perhaps even 2022.

So Alex in that sense teach us a bit more about what’s planned in the blockchain space with regard to partnerships with regard to potential alliances, and even outside of that in the mainstream what can we expect to come in this year?

a — Well that that’s tricky one to answer without breaking NDA’s

b — do what you can

a — I’ll do what I can. Our alpha is scheduled for Q2 — turns out we’re way ahead of schedule and wait — how do I say this, Steve don’t fire me — we have have active clients that are that are what we consider are Alpha testers; we call them premier clients they’re essentially Alpha testers on our MVP. Right now, those clients are using the platform as we speak.

b — okay so essentially the NDAs indicate you’ve got a long list of partnerships to be announced as well

a — We do, and what we’re excited to do is to to have some of those NDAs go away with concurrent launch of the Alpha. Without getting too specific I think our community could be pretty excited about what’s coming in March.

BUILDING A NETWORK OF VALUE

b — Okay now in that context another tough question for you Alex is that often what we see in crypto is when we see legitimate startups emerge, they tend to not get a lot of fomo obviously this is a free interview so this makes sense — but eventually when things start to really roll out and these NDAs are you know removed from the equation and things start to really progress you see marketing entities pick this up. Now sometimes they just do because they want to fomo when they want to shield the steal the token but then there are other legitimate agencies who want to help build out the narrative that’s legitimate and real. So what are you doing there to in in concert with the plan the road map of legitimate exposure to all of us about what you’re actually doing?

a — Absolutely. It’s a great question. So that’s been foremost from the very moment that you know Tommo and I — we kind of joined together — he was approached I was approached and they said, “who do we need to bring on”, and we kind of like that guy you — both of us.

We’re good friends, we’ve known each other and sort of been together in blockchain for a very long time. So we come to this with a lot of relationships. Whether that’s with with other teams that we have either been participated in some way, or as you mentioned you you worked with Tommo on the previous project that he’s currently still with. He’s been ancillarily working with a variety of different projects whether on the books or behind the scenes. I’ve helped behind the scenes. I’ve been an investor in a bunch of different projects.

So we’ve had all these relationships, and in that process we’ve met a lot of the right kind of people and a lot of them — you know — the other, the rest of the of the people

b — Yeah we all have absolutely. And I love that you know that world, because you will not survive in this industry if you haven’t got that experience with it. You just wouldn’t. You would know that. You have to have that crypto-savvy mixed with the mainstream prowess

a — Yeah, absolutely. And so what we’re very careful in who we you know we — obviously my phone never stops beeping telegram never stops — uh you know with this offer and that offer and you know this and that yeah and and by and large we just. “Thank you but no thank you”, and we’re building sort of a network. I call it this network of value and there are these relationships with the people that share our corporate values, share our personal values, and when you find those people you sort of grab on because they have a few too. And we’ve been blessed over the last seven weeks since we launched to have built a really significant, what I would consider a very significant, network of values.

b — That’s fantastic

a — That’s with other C levels at other blockchain projects it’s with people in the marketing sphere some influence you know influencers.

b — No, let’s do it let’s use it because there are some that are actually geared for influence. Let’s just be real.

a — We’ve made some relationships there and, honestly, quite a few of those relationships you know there was no there’s no money transfer. It’s people uh you know.

I’ll give you a great example — not to show anyone person but the very first people to kind of pick us up is Bit Shaman and in Pandah from the Gem Hunters. They just sort of like they just sort of ran across — you know Tommo knows them — from somewhere, and they ran across and they they took a look at it and said, ‘hey come in for a for an ama, and then honestly their community just kind of piled into our telegram presumably…

b — Respectfully thank you again for this transparency. We rarely get this kind of depth and this conversation but it really matters because influencer in the sense of uh those who are geared solely and holy uh to support a startup there’s two types obviously there’s actually many but one of them tends to be built from in the front end from agents in the back so they don’t have a lot of an agenda they’re you know they handled it given a silver spoon and so they don’t really have a lot of context or understanding, but then you get the likes of the ones you’ve mentioned. Who actually do their own research, actually do spend their own time looking at it, so that’s a little bit more than just influence. That’s someone who wants to educate. So you do get a crossover. You certainly do get those who want the $10,000 interview type thing as well, but the agenda once again is organic growth. That’s what I keep hearing from you, is building out something that marries at the long term

a — Yeah, because of the negative connotations of influence are on it on our platform, Steve came up with a brilliant concept — and just sort of erasing that — we call them ‘Curators’. They’re Content Curators because it has a more sophisticated sense of what we’re talking about. There’s sort of trusted individuals in your community of thought, or in your values community, and and they curate concepts for you, or they curate blockchain projects so they curate the right content that you should be reading because you value their opinion.

b — Exactly, so Steve, what are your thoughts because I know you want to jump in here mate what are your thoughts on the philosophy you know that buzzword that buzz phrase that came out recently, “no illusions” or perhaps it was “respect the pump”. You know you see that kind of thing coming out a lot that hot you know idea of come on guys let’s go for the next shill and let’s pump the you know out of it.

Obviously you’re focused on curation you want those legitimate educational sources as well, so how do you manage that navigate in this really shill-driven environment?

s — Yeah. Look it comes down to just the simple word; authenticity.

So we’re in this for the long term you know . It’s coming from a non-crypto background in terms of building companies. What we do in a year happens in a week in crypto right, so it’s it’s been amusing in parts and eye-opening as well. I found it quite refreshing because it’s also kind of pushed ourselves in terms of how quickly we get into [the] market and… it’s actually been really beneficial… It’s actually pushed along our projects, our discussions, our team building probably a faster speed than we would otherwise have attained.

I will I will admit that I’m slightly guilty of the creating the stickers, because they’re just really good fun and they capture a moment.

So again ours is about our whole platform and certainly my philosophy is all about clear communication and we need partners at C-level, partnerships, clients, everybody who kind of come along with that ride, and yeah there’s a huge community who are just looking for you know the thousand x; the moons, etc, and that’s fantastic. It’s a proportion of community, and then there’s also a proportion of community that we seem to be attracting that are saying, ‘Hey, look you know that’s great on one side and that you know that might be five, ten, fifty percent of our portfolio, but actually we need some longer term projects that we authentically believe in, that are are gonna go there and in year two year five years ten years are still going to be there’. And that’s what’s important.

b — And that’s the thing, the sustainability of the support has to be there as well. So Alex you would know that you do have those those those orgs and those communities and those I guess you could call them the shill groups who do architect those really rapid movements in price. You know it really is architected for price only and that can really hurt a team, so hopefully you’ve done your due diligence on those kinds of parties who tend to do that and in that respect obviously you want to make sure that you that the participants and the users and those who engage in payments they don’t suffer you know as this kind of hype is managed, because many CEOs in the mainstream just have no clue about just how dynamic this space can get

a — Absolutely. It’s a balance right? I mean, if you decide to launch a company in the blockchain sphere you know you’re sort of accepting that the market is part of it.

And the health of the VersoView token, and the health of the market for the VersoView tokens very important to us, and while I can’t you know obviously we wouldn’t discuss or we’re not focused on the price of the token at any given time it’s sort of irrelevant to our business, we certainly want our our community who by and large are investors in that token to be happy.

So we’re always kind of looking at that balance between like Steve said it’s everything we do has to be rooted in authenticity, and so you what you won’t see from VersoView is you know the classic announcement of an announcement, just to get a little spike in the token price, or you know us behind the scenes like throwing out things to manipulate this or that. Like we just don’t do that. We set a plan. We meet the plan as best we can, and it is what it is, and what we found — at least in the first seven weeks — obviously, we were benefiting greatly from macro market structure right now, but what we’ve seen in the first seven weeks is that everybody’s happy with where we are, the pace that we’re moving, and the direction that we’re headed. And we’re still very, very small — I think at last check we were at like two point something market millions.

b — Okay, well so you are relatively low cap people love that when there’s legitimacy and and integrity and viability for a future business built in that system

a — With with real global corporations already using our platform. I think that’s the key people just haven’t seen yet. It’s like you know what we haven’t shown anyone. I’m excited to do so very, very soon.

Now, it all sounds great right? I mean VersoView story it sounds great; we have amazing people with great rosters the linkedin’s look great we’re all real, we’re doxxed you know the whole everything lines up, but we just haven’t shown what the platform can do. And when that moment happens, I think I think it’s really going to open some eyes.

b — Well call me when it happens I want that interview for sure.

STAKING WITH FERRUM

b — Now I want to talk about Ferrum as well because you do have a Ferrum connection. I know Ian from Ferrum, and he’s making some waves in all kinds of ways with their technology with their team. You’ve built stake into this model as well so do either of you want to touch on why that’s important to the overall design.

s — I’ll let Alex say that, but your interview with Ian was excellent.

b — oh thank you mate

a — Ian’s amazing. When I said when I talk about ‘network of value’, I consider Ian a part of my network of value.

He’s somebody that I’ve met recently. I’m a huge Ferrum fan personally, personally invested in Ferrum, and then on top of it he’s probably the hardest working blockchain executive that I’ve ever watched. In everything that they do it is done in a sense of integrity and in sort of transparent discipline it’s just done with intention and authenticity.

So staking is a core element because staking is a reward structure; VersoRewards is our branded program of what we call and it incorporates sort of two elements. It’s staking to reward the holders of the VersoView token and create token utility, and it’s also the second component of VersoRewards — something that hasn’t been released yet but will be soon — and that’s the perk system, where the Social Tokens reward the engaged users of the platform.

For instance, hotel chains are a perfect example there. If you have 10,000 of xyz hotel token, you get a free night stay with every booking, or you get an upgraded tier. The hotel can customize their rewards program and their perk tiers around what works for them. They’re fully customizable rewards programs. VersoRewards is that two-pronged approach.

Now, the platform’s just not ready to handle staking, but Ferrum has staking as a service. It’s brilliant, it’s smooth, it’s clean, it’s low cost. One of the biggest issues I’ve seen in blockchain is you can get really excited about a new project, you pick up some of the token, you log on to their staking platform and either it doesn’t work — it’s not secure or it costs for each to stake — because it’s routed through a million different texts. Well, Ferrum created this super simple, super beautiful streamlined staking as a service and we said, ‘why reinvent the wheel?’

So we leverage a partner, we leverage our ‘network of value’, and we integrate something better than what we can put together and [together with this, we] build a partnership and a friendship that will evolve.

b — I spoke with Ian most recently about the Foundry as well and again that’s not to plug, it’s just the reality is that the curators involved in that they are incentivized to invest if they wish, but it’s also longitudinal. So what I like about that is right from the outset is transparent — we were very clear on the interview but in that respect is that it’s not about being paid in any respect for the informatio, it’s about if you believe in the projects you can get involved but the network is what I found interesting. In this country in this sort of partnership that’s emerging where you know Ferrum obviously has access to that. So, are you leveraging that? Are you making sure that those curators have who seem to have the same agenda — me being one by the way in and I do have certainly have a little respect for the approach and built that in the way that you move forward?

a — ….Our partnership currently with Ferum extends to us being a client of theirs for staking as a service and I consider Ian a friend, and beyond that we were not incubated by the Foundry, and we don’t plug into their their influential network. I don’t want to overstate the partnership. I want to be honest about it.

b — No, I appreciate that.

a — Any time I meet somebody that that I see a reflection of myself in their work ethic and in their value set, I’m always looking to leverage that for more opportunity and we’ll see what comes.

b — I’m sure that relationship with Ferum is also beneficial for the many roles that Ian’s now playing as he builds out you know his own platform, so congratulations on building in the staking system.

Now Steve, do you want to touch on anything with regard to the staking model itself? It is a technical question but it is something that does build long-term value in the token model, even when in your case you are a payment token.

s — I’ll be very brief on that because I don’t have that kind of Defi background here, I’m kind of marketing and visionary that respect in terms of the platform.

The staking was almost a no-brainer for us. We’re about rewards, and that’s a very authentic use of rewards on our platform in early days. It’s a very natural fit for us and that’s important for us as well — in terms of doing things that are reflective of what the platform intends to be — so that kind of natural fit and that transparency is also very important.

UTILITY, TOKENOMICS & REWARDS

b — Absolutely, yeah mate. Now tough one is regulation. Now one of the things I mentioned this pre-interview, and just for transparency to everyone, absolutely this team was transparent they did not change any questions they let me rip you know into whatever I wanted to which I really appreciate.

Now with the word ‘currency’ or the word ‘payment’, these things do come up in literature, so I wanted to get some clarifications so that we can understand how that fits with regulation, and what you’ve done to make sure that this token can be viable as stated.

a — Sure. So the VersoView tokens’s a utility token in its core. It serves as a core feature that functions within to move value within the ecosystem. So, in that sense I think the word ‘currency’ that may have appeared in our literature is sort of it’s just a nomenclature situation, and it was reviewed by our lawyers, and they didn’t have a problem with it regulatory — and as far as regulatory issue is concerned — certainly that’s something we can review.

What we think of it as is really the VersoView token is it’s the core of values; it’s the lifeblood in the center of the ecosystem. When we use the word ‘payments’ it’s the ability for a content creator to sell their work. If you think about right now, NTFs are all the rage — and we’re incorporating NTFs in our project in two ways. One is core to our platform in the sense of being able to NFT the work of content creators. If you’re a photographer and you want to sell your freelance photography and other publications can come in and purchase, or utilize, or syndicate that material into your their publication, they can compensate you right there on the VersoView platform in that exchange of value with the VersoView token, so it is a payment.

b — Alex, let’s talk about that because it’s so fascinating. We’ve heard in 2017, 18, 19 similar sort of structures whereby the payment was the primary use case. You mentioned that all important term legally as well with utility token that’s obviously important for making sure you’re properly regulated in various parts of the world, but the big question is if payment’s a primary focus of this why even do it?

Why not just use fiat? Can you teach us a little bit more about why you as a team need to have this token. What we w’ere talking about before, that decentralized arm or that open Fi into you know the broader space where we can only you know use it for what it’s for and that’s expanding the social tokens.

a — I think that came up. Steve and Julian can talk about the history of their thinking around this. Ultimately corporations who utilize those publications who utilize this can pay in fiat so it it doesn’t require them to purchase VersoView. When they do, we take a portion of that purchase VersoView and then it runs through our revenue mechanics which incorporate the token into the revenue component of the platform both in advertising and in subscription modells. That’s the incorporated component.

The problem with going a straight fiat model for VersoView, if we just sort of eliminated the token, we hamstring all of the opportunity that we have for our feature set . For instance, Social Tokens are out, which means our reward structure [is out]. How do we create that reward structure? So the rewarding currency, or rewarding viable currency, becomes a taxable event. It’s jurisdictionally a problem. So unless you can give a business the option to close, to wall off or close, their ecosystem, you can’t give the jurisdictionally sort of non-border with the rewards program. Otherwise you end up creating taxable events in that scenario. So we allow the corporations to choose ‘yes’, or ‘no’, but in order to do that it almost has to be a blockchain solution. If you do it with fiat it’s there’s no other option.

b — Yeah, absolutely it makes perfect sense. So the big question is why have them on exchanges? You know because obviously there’s a specific purpose for this it’s utility driven, it’s for users and for attracting more and garnering more support in this use case of making sure that the publishing and the rewards and the curation all blend beautifully together. But then there’s the anomaly of the exchanges, and speculation that can affect everything so rapidly — as you both know. So how do you navigate through that?

a — ….If you think of it like, we use the term ‘blockchain’ sort of to avoid saying ‘cryptocurrency’, right?

b — Right.

a — So blockchain — the technology of blockchain — is excellent and it’s foundational to what we’re doing and filling the role. But without the token, and the token movement, and the transactability of the token then ultimately it limits your rewards program as well.

So you want a rewards program to have value, and the businesses themselves can create their own customizable reward structure with their social token, but they can choose the value proposition of that social token… If they want it can be transactable back and forth between VersoView, and in that case, the only way to make it have value is to create a market for it.

So we have to have a market place that’s accessible for an in and outflow of money of fiat currency into the VersoView platform, or else it would just be us throwing points around in that that never go anywhere.

b — Exactly, exactly.

a — So ultimately the hamstring of all of the current rewards programs, they’re sort of one-directional, and they have no value. They’re not really exchangeable, and they’re not transactable other than in the most narrow and most basic sense. And you’re looking to expand that way beyond what’s currently capable, and the only way we can do that is the blockchain. It’s sort of integration between these potentially closed or open ecosystems within social tokens, but then also that sort of off-ramp back to fiat.

b — Yeah great, great. Really well said. So essentially the token unlocks the power of , I guess, the global eco that you could tap into.

Here’s the tough one. So why not just have some sort of crypto-centered stable coin? Because volatility is something that I would imagine might be a concern for a viable business. I’ve come across this before with other entities that have been centralized by design had that internal proprietary tech but then they had the token challenge of this fluctuates so rapidly because of all the craziness that happens.

How do you mitigate the volatility risks of this? Say that you know it can be deemed as something that’s legitimate usable viable in spite of its volatility?

a — That’s actually come up quite a bit in our meetings. In fact we’ve we had long conversations before about whether we should be looking at a stable coin, whether we should be you know minting a second token that’s a stable coin to balance out ‘this and that’. The end result is ultimately the transactable function or the core features of the rewards token, the social token rewards token components, they’re determined by the entity that want that that wants it.

So if xyz airline wants to create a rewards program with us they receive VersoView tokens as a starting package from the ecosystem rewards pool. They stake those. Mint xyz token. xyz token can be a stable token. It can be a fluctuating token. It can be a closed point system with no value. It can be an open system where you can buy and sell it or trade it. They can create the dynamics around it, so we actually just leave that door open to the end user.

What it does is by having it be a fluctuating value token with a market value, it allows the decision making — or the flexibility — to fall onto our client, as opposed to us sort of making that higher-level decision making process, and then fix this right into that box.

b — It’s really interesting because the client can also tokenize. Is that correct? Because we reference social tokens in here, so would that mean that you’re in a sense almost a platform coin or a platform token? You know by proxy, or by default, because essentially your UI, your own platform it’s written out in the roadmap.

a — Right we’re not we’re not launching our own blockchain.

b — But you do have a platform.

a — We do have a platform. We have a platform, and in the App, the application technology is a platform, and they can mint tokens … those tokens will be minted on whatever chain makes the most sense at the time.

I mean right now we’re currently in ERC-20 — hopefully, a layer two solution or ETH2 changes the current gas situation — it needs to by summertime, or else we’ll be looking at other chain options. Right now we are not pigeon-holed in any given direction, and our tech team is looking at that.

b — Fantastic.

a — But right now, ERC-20 is just sort of the easiest, sort of most straightforward token with which to begin a journey. …Once we have these chains, whatever chain we end up on, we’ll mint tokens on those chains. We’ve looked at Polkadot; we’ve looked at some dex solutions; we’ve looked at a variety of different of options that make the most sense, and when the time comes we’ll make that decisionn. Ultimately we won’t build our own chain simply because, in my opinion and I think the team at large, the resources needed to build something that other people are doing — Gavin is building on some Substrate [and] he’s so far beyond anything we could hope to be — why would we try to recreate what he’s doing?

b — Exactly.

a — …what Vitalik’s doing, or what any of these geniuses have already done. There’s something that fits any blockchain project. To create another one at this point at least in what we’re doing would be just a massive waste of resources.

b — Well you’ve got a big tick for me because soon as I hear the term agnostic and the will your willingness to move across according to the dogma of innovation. I mean you really do have to. You don’t have a choice in business, and true techies and true business-oriented people really don’t care at the end of the day which platform is the preference for a maximalist. They care what’s efficient. They care what’s usable. So everything you said gets a tick for that reason, because you want to advance.

TWO BILLION… 2.000,000,000

b — Now with regard to the token distribution to economics, I did want to touch on that gentleman for better understanding. You mentioned right now you’re relatively low cap, that’s just in the context of release and scenario in terms of circulating supply, and overall supply. There is a difference — a significant one between the two, as you know.

So why is that the case, and then we can talk about how distributed this token as or well?

a — Two billion tokens I mean that’s a that’s the elephant in the room I think most people come in to our telegram or they they ask us the questions so like, ‘oh my god, what? When are you gonna dump these on us!’ Right, that’s the expectation.

…I mentioned when a client comes on board, we’re not onboarding blockchain-sophisticated companies. Most of the companies that we interact with have no experience with blockchain or limited experience with blockchain. They certainly don’t have the sophistication around wallets and and purchasing and tokens and like all of this is is completely foreign to every single C-level executive who we’re talking to.

b — Which is amazing. That is amazing to me, because it’s been going for some time now you know…

a — …But it’s just not something that businesses have invested in at this time in any large amount. There’s some. You see Michael Saylor buying up bitcoin left and right, we know Elon’s probably is behind the scenes — there’s a lot of other ones, but they’re a tiny micro percentage percentile, and our clients… really just haven’t seen it I don’t think, Steve, we’ve come across a single one.

b — But Steve and Alex, in that context though we Definitely saw Facebook, for example, illuminate the potential of a token that relates directly with proprietary tech with mainstream businesses and that went around the world when they were talking about Libra (Diem) as you know. So surely businesses are a little bit more savvy than what we’re suggesting here? Where they’re not exploring, or at least paying attention to the sheer success and narrative of what’s been happening in the beyond bitcoin world.

s — There will be an increasing uptake in that and I think we’re going yo be very well positioned to absorb that increase as well — in terms of our time-frames and kind of getting people to dip their toe into the world of blockchain without truly knowing that it’s blockchain.

It’s quite a a soft entry point for them with the social tokens and rewards. It kind of then talks to a marketing narrative that you can communicate with. Again that comes back to us in terms of ensuring that we have a solution that can be can be communicated clearly to both clients and users…

Currently there’s a lot of skepticism obviously about crypto and blockchain, and a lot of people don’t want to go near it because they just assume at C-level, or slightly below, that there’s going to be something’ bad’ happen.

There’s going to be there’s all these bad things everybody is ‘oh, bitcoin’s not real’; …and then there’s the other people saying ‘well, bitcoins’ the new gold’, etc. So there’s a lot of gray area, and a lot of I would say nervousness, because you don’t want to hang your hat into blockchain and saying this is what we’re doing with all that kind of grey area.

b — Yeah, there’s that apprehension as well, born from even governments as you appreciate because once you start talking about payments you’re talking about utility you’re talking about all these different functionalities built into almost [an] element of currency as we’ve alluded to. Governments are starting to freak out a little bit because they’re thinking these businesses, they’ve got some serious power beyond just having a traditional reward for their in intra company.

a — One of our premier clients using our MVP right now is is in a jurisdiction that just simply does not favor or allow cryptocurrency. So it is an issue and it’s something that we are navigating daily.

But to your to your previous point, what we’re looking at all these corporations — you’re right you’re absolutely right — in that anyone who’s running a successful business has got it in the back of their mind of, like ‘what is this? How?’ …no one wants to be first, but nobody wants to be last right? So we feel like we’re really uniquely positioned. The creation this sort of addresses that elephant in the room of why do we have two billion tokens?

ECOSYSTEM REWARDS POOL

A huge amount of those tokens sit in something called the Ecosystem Rewards Pool. That is a locked pool of tokens that never enter circulation.

Let me get into explain that how that works.

So you’re a blockchain, you’re a C-level executive who publishes a magazine and we talk to you and you say, ‘Okay this sounds great’, and we go; okay, great now you have to buy tokens, so just go ahead and get a uni swap account; figure out a fiat on-ramp; get a uni swap account; go buy tokens from some dog…

b — They’re never gonna do it right?

a — Right. They’re gonna go, ‘whoa, whoa, whoa! Buy what?’ So we realized right out of the gate that what would happen was all the corporations would come in, they’d use the tool and ignore the token. So in order to create utility for the token; and in order to ensure the utility of the token; and the robust nature of the platform (because if we just allow them to use the tool, they’re not going to get the rewards component, which is going to lose the engagement and the entire system collapses).

b — Exactly.

a — So what we did was, we created the Ecosystem Rewards Pool and we said, ‘all right, well we’re going to actually give away (you know the old saying the first one’s free right), we’re going to give them a taste.

So we take the tokens. We lock them on their behalf directly into a smart contract — now they’re blockchain token holders. They hold VVT. They don’t ever actually get it, and if they leave the platform the tokens that we gave them revert back from the smart contract to the ecosystem rewards pool.

When you look at those I think, don’t quote me on this, but 300 million tokens — those those don’t exist, they’re never going to get into the market. So they’ll never enter circulating supply, even though they’ll be being transacted between us.

b — That’s really interesting. So you have a very finite number allocated for business on the blockchain, or business rather in the ecosystem itself, and they are distinct they’re very separate from everything else then.

So how do you get the number right? What happens if you have you know…

a — The pool grows. If you look at our revenue mechanics, a percentage of our advertising revenue and a percentage of our subscription revenue is siphoned out and it buys VVT tokens. One third of those tokens goes in back into refuel the staking rewards pool that rewards VVT token holders to perpetuate that program in perpetuity; one third goes into a 0x00 address as a permanent lock; and one third goes into the ecosystem rewards pool, which is an effective lock, but it refuels that and expands that program.

Then we simply adjust this we can adjust the staking mechanics to get those numbers right of how much VVT is needed to mint x number of tokens, but here’s the key point and what really adds value for our ecosystem and our token holders.

Once again xyz airline joins us, and they have a rewards program, and they have a bunch of users right and we give them — I’m just making up numbers here okay so don’t kill me — but we give them a hundred thousand VersoView tokens that stake into a smart contract. Those are not in circulation, and they start their rewards program; they’re just dipping their toes for free, why not try it? They start using it they realize the value; they start to see in their engagement, they see it in their revenue numbers, they see it in the effectiveness of their program and the feedback from their consumers. But it’s not enough. What happens now? Well how do we grow our program? We need more tokens. They buy it from the market, and we facilitate this.

b — This is a really good model actually, because you’ve had that finite amount to incentivize trust with the businesses coming on board. But then you also have liquidity pools as well, both for now in the future, to make sure that you can continue to iterate in what you’re planning on technologically, but also make sure the token is not going to suffer as well. Because you’re going to have high demand.

I’ve often come across in discussing these kinds of locks before the other companies that they were always worried they’d run out. That eventually there would be a situation where they just can’t service the need, but clearly, you’re building this in and that also relates back to that really high total supply. If you didn’t have that, I probably wouldn’t even talk to you to be honest, because it doesn’t make sense to have a low supply for a business of this nature.

a — It does. You look at a great company, VersoView. I mean VersoView, that it is a great company, but that wasn’t what I meant. VeChain — look at VeChain; they did the 100:1 reverse split because they realized that having an $8 token, or an $80 token just doesn’t work — you can’t scan an NFT and it costs 80 bucks, you know.

b — Polkadot did that too with the migrations, sorry with the amendments, and even Bounce recently did that, where they switch across… It’s got to be more competitive, it’s just its logic right?

a — So we had to have a high supply. I mean it just had to happen. We have these other pools; development pool, and marketing pool, and exchanges… we have these sort of sitting here, and we’ve said right out of the gate we’re not going to emit any additional tokens in the first six months.

So that’s through June — internally we’re looking at where do we need tokens, what would we need them for? As a general philosophy as a team, less is more in the emission schedule. We’ll have more on that sort of in the next couple of months about what we are thinking around that, but I don’t expect the vast, vast, vast, vast majority of those tokens to ever enter circulation, or if they do by the time they do the revenue mechanics that actually create a deflationary mechanism through our revenue will offset that. Because ultimately, one of the problems with staking, or yield farming or anything else that in this sort of Defi world is it’s inflationary –

b — Especially if they incentivize for a short period in the beginning as we’ve seen.

a — With high incentivization. Yeah so you get these unsustainable yields, just jumping from yield to yield to yield to yield, really essentially it’s a Ponzi scheme…

b — It’s farm popping…

a — So we wanted to create … a rewards program that was still attractive to the VersoView token holder in both a long-term value, but also in a short-term value to hold while they’re waiting for this revenue this revenue to kick in, but once the revenue kicks in for the company and it begins sort of putting deflationary pressure on the marketplace, then that’s when the real value and health of the environment is created.

b — Yes, and because of the plasticity of this in the way, it sounds like you’ve spent a lot of time on the token design. You know, whoever was involved in that — it hasn’t been one person I would guess — because this is a comprehensive discussion from you, Alex, and one day I’ll have a conversation just with you.

We could unpack this on an interview because it’s so much involved, but what’s clear is that if you’re a speculator and you’re just listening to this interview you’re hearing straight away that so many mechanisms are built in to make sure that over time — you can’t comment on this but this is what I’m seeing the price is going to correlate with increasing staking — it’s just going to because that’s the logic of bringing in this business. …You’re very new now, but let’s talk in a year and things are going to be very different with your price — don’t comment on that — but that’s what I think.

TEAM ALLOCATION

b — Now with regard to competitors out there, what about that? Sorry I want to interrupt and just say what about the team? In terms of the distribution, that’s important to sort of push you on. That it’s quite high and the team get 20% as I understand. Why so much so?

a — That’s another function. It was an arbitrary selection in the beginning… We’re actually looking at building a 40-year business. I think a lot of projects think 24 months right, like… ‘hey, we’re going to lock our team tokens for one year and then admit them over the next year’. …When I see that, I just thought they’re gone — it’s a two-year business. We’re looking at being a 40-year business, or 50-year business.

This is a business that I want my kids to like come work for VersoView, and then like take over you know and Steve’s kids are going to become the new board of directors and and Julian’s kids will be the next generation of board of directors. When we build a business that’s what we’re thinking about.

So what you need is [a plan for when] that’s a hundred people, that’s a thousand people, that’s ten thousand people working for you. …You need to be able to reward talent over a long period of time. So if we don’t have a large pool that we can tap into with, essentially golden handcuff-style compensation packages over a long period of time, we’ve hamstrung ourselves potentially.

These types of things are pools that we’re flexible with so if we tap into it great if we need it that means we’re a massive team with a massive organization with huge revenues driving a really healthy environment so the emissions don’t matter as much. But if we aren’t then we can lock those longer or we can reallocate them, or we can move them into the ecosystem rewards pool we can do whatever we want with them but it’s it’s keeping flexibility in our token distribution early.

b — You know that’s something quite rare. I very rarely… I actually haven’t… I don’t think talked about flexible token distribution. Distribution and tokenomic designs, that’s openly from the outset.

Now, how do we — given that you’re talking about you want to be you know decades long of business and if not longer — how do we trust provably, not just relate through relations, but provably, that this team is locking up? Because it does make me nervous to think that a team could technically, at any point in time, because of flexible designs, see you later!?

a — I mean, here’s the thing. This is going to sound like a cop-out answer, but there’s no protect there’s no safety in in crypto. You’re trusting. If we put a smart contract lock, we lock our liquidity, and then you can dump the token. You lock the token, but then you rub the liquidity pool.

There as many creative people and ingenious people as there are in crypto, there’s a a thousand ways to completely scam the investments. There’s no locks — anybody who’s selling the next ‘this is gonna make scams go away’ — what it does is it adds one more layer of trust. That’s it. But they’re already people are figuring out how to [bypass that]. All these new ways that they’re attacking the yield pools, and pumping on the flash loans… I mean, people are so smart and these quantitative minds are so good that they can come up with a scam any way they want. So at the end of the day when you invest in a company — and this this is true of any company not just blockchain companies — you have to trust that

b — But what it’s all it is but what about lockups, Alex? You’re seeing that… and there’s even narratives of hierarchy, because just because we say that a VC has the best reputation doesn’t necessarily mean that. That’s the case when we look deeper. You really have to explore. I guess that the dynamic that is crypto and how everyone relies so much reputation, but what is coming out recently is provability as a in accordance with the transparency of lock-ups for teams for advisors, etc. So have you done anything like that, or is it just where every advisor and team has access to some of the tokens from the from day dot?

a — The liquidity pool was locked up smart contract. …as far as our token pools, we’ve put them we’ve allocated them in individual places — we’ve transparently put the wallets exactly where they; we’ve shown the community exactly all that information is available, readily available; this is the marketing wallet; this is the address this is what it’s for; and they can keep an eye on it.

We have not put smart contract locks on those for a variety of reasons. One of them is simply coding expense. I mean, it’s not easy moving 400 million tokens — it is risk and there’s there’s always risk. There’s smart contract risk, coding risk, so to just sort of arbitrarily put a bunch of smart contracts that we code in place and then start moving tokens all around and just sort of hoping for the best, and then where do you lock them up? That becomes the next question.

What I see a lot of team teams do, is they put like seven day multi-sig calls on their smart contracts but all that does is give you a seven day heads up. If you’re watching etherscan right? So it’s really no different than watching etherscan itself, otherwise what do you do?

You say, ‘okay we’re going to lock our pools for a year, but then what happens if circumstances change in six months and you miss an opportunity? [If] we had an opportunity to score a really incredible hire, but we needed to be able to offer them a hundred thousand tokens or a million tokens or something to sweeten the deal to the point that’s going to add so much value to the ecosystem, and the team and the project, but we can’t because we lock the tokens for a year? We say, ‘hey trust us, we’ll give you your tokens’?

So we have to create flexibility and from the standpoint of the risks associated with moving crypto at any given time, of storing it safely and securely, of trusting smart contracts, additional coding risk, to me… I don’t know that it adds that much more comfort to an investor, because there’s you can literally just screw them in a hundred other ways.

So at the end of the day, I think what what we can say to our investors, or to anyone looking at our company, is look at who we are. Look at Steve; look at Julian; there’s a 25-year reputation with multiple eight-figure businesses that they’re sitting on. Do you think they’re going to rug a token project over $70k?

b — Well, Alex, this is crypto! You know there are narratives out there with people behind them, and you know people from universities even paid to represent the through reputation for certain stats that did rug pull, so of course that will happen in different scenarios.

But in your context, what I like is that you’re willing to be transparent about the actual trend the hash, you know, the hash key but having that transactional hash available people can go and check as you said through etherscan.

And you’re saying that look we are flexible, we’re not going to pretend we aren’t, but we’re doing it for the reason that we need to be able to build that in so we can you know use these resources as we need to build this company.

ACCOUNTABILITY

b — So are you going to make sure that you disclose any updates as you shift around in this flexible design so people know that what you’re spending the money on, or what what that you know is purpose for as things change?

a — Col Werner is our our CFO and Col is incredible with the numbers, and is going to be putting out quarterly reports. I think our first quarterly report, the very first financial report of the company will come out on at the end of March on the end of quarter one, going back from December 2nd when we launched, through quarter one. We’ll continue to do that. That’ll be a quarterly thing… so they can look at sort of our funding token movements; any token selling or anything that we needed to do in that process will be all contained in that financial report.

More importantly than that, if we move tokens out of a locked or locked, an allocated lock pool for some purpose the community is told about it.

There was a circumstance where that occurred, so our Gold pool staking is locked up for five months. The purpose of that was it drops in June. There was 3.8 million tokens worth of rewards that are added to that smart contract now. In order to to keep our commitment to the community, we said okay we’re going to take those tokens because it’s more than we have in circulation — that we the team don’t have the tokens to provide the rewards, but we have to fund the smart contract — so we take them out of the pool, we fund the smart contract, but in that particular pool there’s no early unstake rewards. If you want to unstake early, you get nothing.

So those tokens cannot enter circulation until after the six-month commitment is up, at which point they will enter and increase the circulating supply. Before we did that we told the community; hey this transaction is going to happen. Simple. Nobody cares. They want rewards, to know what’s going on. People are smart, and this is an incredibly incredibly savvy retail investor environment and all they want is the truth. They just want authenticity.

b — That’s true, that’s all they care about.

a — And so if we have to make a change, we say. ‘hey guys we screwed up, we only put 300 million in the ecosystem rewards pool, and we put this other 200 million over here. We made a mistake, we’re going to move 100 from here and put it there because of this reason’. No one’s going to say say no.

We’re exploring some marketing strategies or opportunities, or we’re in discussions within a centralized exchange because of the gas problem, we need to pull 10 million tokens out of the exchange pool and move them into circulation.

b– Yea, it makes sense.

a — People are going to be okay with it. They just want to know the truth and authenticity.

b — And that’ll be reflected in the Telegram and any other social platforms that you utilize that will show based on feedback based on growth of numbers as well.

Now one of the things we didn’t touch on is that you know in discussing the potential for rug pools, often indicators are there based on anonymity you know if your team’s anonymous, or even a pseudonymous that is a red flag often, because you know their risks are very high when they can just be nobody they can literally be anybody they want. And we’ve seen this you know in liquidity mining incidents and even as you mentioned with those very creative very effective flash zone incidents, as well all kinds of anonymity builds into this and adds risk. You aren’t that, you are literally right here. I can see you, I’m listening to you that matters I think a lot in business.

TRANSPARENCY

b — Now gentlemen, one of the things I really wanted to ask you about both is what about things like exchanges and whether they be dexers or sexes or cex’s — are you talking to the crypto world in terms of continuing this line of progress in terms of liquidity? Because often that’s what happens [is] you launch the token, and then different people in the teams they have connections to the right people in the right place.

s — I’ll let Alex obviously answer that one but in terms of our approach.

So corporations, in general, over the last several years have had this big push towards increasing demand for greater transparency, and that’s the ethos that we’re also adhering to. So that’s obviously pushed initially by millennials…

Coming back to publications. It used to be like an enterprise would have Annual Reports & Accounts. And that’s it. Whereas now you have employee magazines, health and safety’s, AGM’s, logistics, minutes, internal reports, disaster planning, energy efficiency, yadda yadda yadda yadda…

There’s a lot of communications coming out — and all of those are seeking to transparency, and that’s really what we’re also about.